Money talks, so let yours ROAR!

Navigating our personal contributions to climate change can feel like a challenging puzzle. Despite our conscientious efforts, such as recycling diligently, minimising meat consumption, and mindful purchasing, the ominous shadow of large corporations persists, polluting and resisting change. It's disheartening to gauge the true impact of our individual efforts within our own little corner of the world.

So, how can we elevate our influence and take the next meaningful step? In this piece, I aim to present a gateway to heightened impact—ethical investing through your superannuation fund. Yes, your super, often relegated to the background of our financial lives until its fruition, holds the key to your own miniature revolution for a substantial change.

By actively withdrawing our financial backing from industries that pose significant challenges to our environmental and social issues, we are effectively seizing control.

Vive la revolution!

Before we embark on this transformative journey, it's crucial to comprehend the landscape of industries woven into the fabric of superannuation fund investment strategies, discerning between ethical and non-ethical pathways.

It appears straightforward initially – if you prefer your finances not fueling the production of weapons or contributing to more mines, consider shifting your funds to an ethical investment option.

However, pause for a moment, as there's more to this than meets the eye. Each fund adopts distinct approaches to construct its portfolio. Some employ a strategy of identifying and avoiding undesirable industries (negative screening), while others focus on actively including industries aligned with ethical values (positive screening). Therefore, merely googling an ethical super fund might lead you to a product that merely eliminates a few problematic sectors while still investing in areas like gambling, pornography, human rights abuses, and tobacco. It's essential to delve deeper into the fund's screening methodology to ensure alignment with your ethical stance.

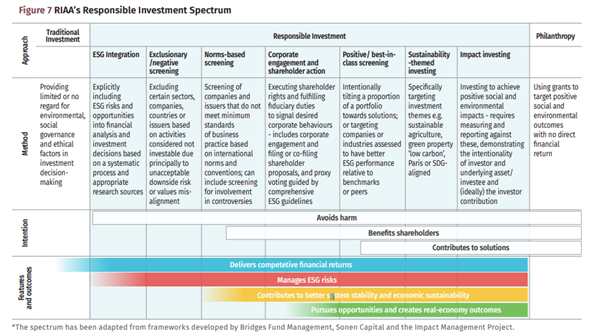

To help you understand a little more about the responsible investment spectrum have a look at the below chart from the Responsible Investment Association Australia (RIAA) which clearly defines how responsible investing is categorised.

The RIAA organisation assists people in making far more informed decision making, their mission is - To promote, advocate for, and support approaches to responsible investment that align capital with achieving a healthy and sustainable society, environment and economy.

When venturing into the realm of ethical funds, it becomes crucial to discern any traces of Ethical Greenwashing or deceptive language that might be prevalent. This is where funds might make inflated claims or liberally use the term 'Green' without transparently detailing the entire spectrum of investments within the portfolio.

Now that the seed of change is planted, let's shift our focus to performance. Holding oneself accountable to ethical considerations is paramount, but it must also align with sound financial principles, especially when dealing with funds designated to support your retirement.

When comparing different funds, it's imperative to ensure an apples-to-apples comparison. If you're contemplating a shift from your existing Balanced super fund, target only ethical Balanced options for a fair evaluation.

For a well-rounded understanding, platforms such as Finder (https://www.finder.com.au/super-funds) or the ATO (https://www.ato.gov.au/single-page-applications/yoursuper-comparison-tool) can provide an informed overview.

If you are still not entirely convinced then check out this campaign that the UK have recently put out to help consumers be more informed in their superannuation decisions - remember that Being informed means making informed decisions, so do your research.

This article does not constitute as financial advice and the content provided is for informational purposes only and should not be considered personalised guidance. Remember to consult a qualified financial advisor for specific advice tailored to your individual circumstances.